The Swedish bank SEB today announced that they have blacklisted 40 international companies from its actively managed portfolios.

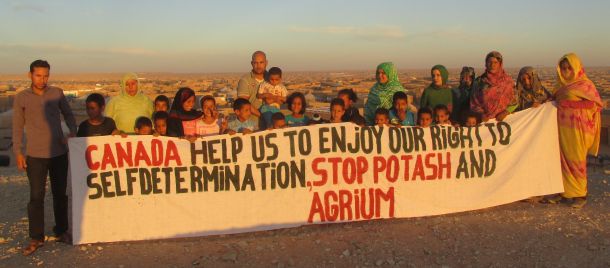

Among the excluded companies are Agrium, PotashCorp, Incitec Pivot and Innophos Holdings. The four companies are all four stock exchange registered companies appearing in the trade of the controversial phosphate rock appearing in the report P for Plunder 2016, published by Western Sahara Resource Watch on 25 April.

SEB is a Swedish financial group for corporate customers, institutions and private individuals with headquarters in Stockholm. Its activities comprise mainly banking services, but SEB also carries out significant life insurance operations.

Later this year, the exclusions will also apply to SEB's index funds.

A large number of institutional investors have blacklisted the four companies due to their contribution to undermining of international law. Agrium, PotashCorp and Incitec Pivot have long term supply contracts with the Moroccan government company that illegally exploits the mine in occupied Western Sahara. Innophos Holdings its sourcing its rock in Louisiana from PotashCorp.

There is an ever increasing legal-financial risk involved in the pillage of the conflict mineral. On 15 June 2017, a court in South Africa is to decide what to do with the case of the bulk vessel NM Cherry Blossom currently detained in the port of Port Elizabeth. The vessel contains 54,000 tonnes of phosphate rock on its way to New Zealand.

Last year, WSRW wrote an overview over other private-public investors internationally having divested from companies operating in occupied Western Sahara in partnership with the Moroccan government.

Morocco has illegally occupied the territory since 1975.

European banks divest from unethical Sahara fertiliser industry

At least six Scandinavian investors have the last few years divested from international fertiliser firms importing from occupied Western Sahara.

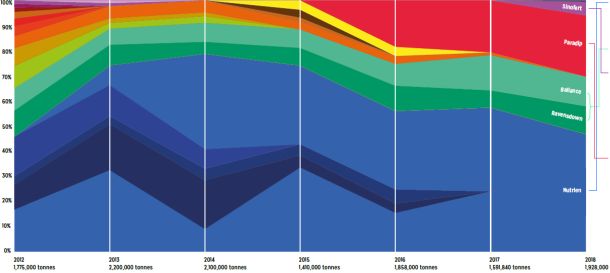

New report: Western Sahara phosphate trade halved

The export of phosphate rock from occupied Western Sahara has never been lower than in 2019. This is revealed in the new WSRW report P for Plunder, published today.

New report on Western Sahara phosphate industry out now

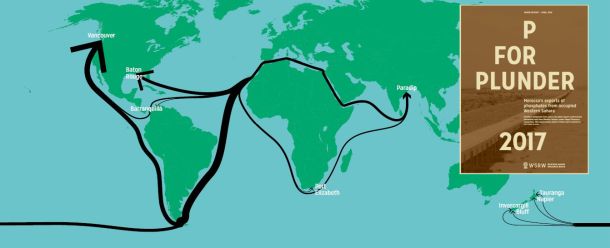

Morocco shipped 1.93 million tonnes of phosphate out of occupied Western Sahara in 2018, worth an estimated $164 million, new report shows. Here is all you need to know about the volume, values, vessels and clients.

New report on contentious Western Sahara phosphate trade

Morocco shipped over 1.5 million tonnes of phosphate out of occupied Western Sahara in 2017, to the tune of over $142 million. But the number of international importers of the contentious conflict mineral is waning, WSRW's annual report shows.